No matter which scenario of global energy futures you subscribe to, natural gas usually plays a major part in the mix for decades to come.

The process of moving away from fossil fuels is gradual. This provides challenges and opportunities. Challenges in reducing emissions to stop climate change and opportunities for technologies like the fuel cell.

It's well-known that despite being invented more than 170 years ago and having no emissions at the point-of-use, fuel cells have proved difficult to develop into reliable, everyday devices. The “just around the corner” technology has remained out of reach for most applications, despite many claimed breakthroughs to reduce their cost or increase their longevity and robustness.

It's only now that we are seeing the beginnings of real mass adoption of fuel cells. Professor Nigel Brandon, chair in Sustainable Gas at Imperial College London, says: “There has been many false dawns with fuel cells, but we are now coming to the start of commercial roll-out, particularly for stationary power and heat.”

Brandon's statement is supported by the growing sales of fuel cell systems in the US and Asia. Market analysis from industry watchers such as Navigant Research predicts growth in the global stationary fuel cell market over the next decade. A report from the consultancy published last month said the sector will grow from the $1.2bn it was worth last year to $40bn in 2022.

Mackinnon Lawrence, research director at Navigant, says: “With the growing need to enhance grid resiliency and the accelerating adoption of distributed generation technologies worldwide, the stationary fuel cell industry is well-positioned for growth over the next decade. We expect it to break through the $2bn mark in annual revenue this year.”

The US market is led by three players, Bloom Energy, Clearedge Power and Fuelcell Energy. According to Navigant there are four main applications where fuel cells are being used first: prime power, large combined heat and power (CHP), residential CHP and backup power. “Stationary fuel cells are seeing increased financing options for adoption, particularly in the healthy residential combined heat and power segment,” adds Lawrence.

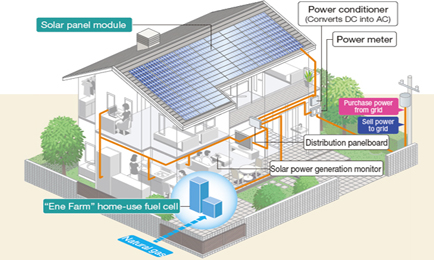

The US market is developing, but Asia, particularly Japan and South Korea, is leading the global fuel-cell renaissance, with subsidised programs such as Ene-Farm in Japan and the Gyenoggi Energy Park in Korea. Ene-Farm subsidises fuel cell units made by large OEM's such as Panasonic and Toshiba. Around 60,000 Proton Exchange Membrane (PEM) units at £10,000 each have been sold so far. A government subsidy of around £3,000 is currently available. The Japanese government aims to have sold 1.4 million units by 2020 and 5.3 million by 2030.

The PEM microCHP systems produce up to 750 W of electricity with heat recovery. The next generation of Ene-Farm units use solid oxide fuel cell (SOFC) technology to increase the system efficiency of the units and reduce costs. Professor Brandon from Imperial College says the overriding benefit of fuel cell microCHP systems is that you get the benefit of CHP, without having to retrofit a district heating system. “The critical driver for microCHP is the heat to electricity ratio,” he says. “The high efficiency of the solid oxide fuel cell saves you more carbon across a wide range of buildings in heat-led applications.”

The Ene Farm program in Japan aims to drive down the cost of domestic fuel cells

The Ene Farm program in Japan aims to drive down the cost of domestic fuel cells

“There is no device more efficient at making energy than a fuel cell. On a small scale it's approaching 50% electricity out for chemicals in and approaching 70% for large scale megawatt gas turbine hybrids, plus there are low emissions,” says Brandon.

One company looking to take advantage of the market's growth in Asia is Ceres Power, a fuel cell technology developer spun out of Imperial College more than ten years ago. During the last decade the company has refined its low-cost “steel technology”, but failed to pioneer the market in the way it initially promised. However, chief executive of Ceres Power, Phil Caldwell, says the company is entering a new phase.

“The fuel cell market around the world is going through a second wave of commercialisation,” says Caldwell. “Adoption is being driven by pure economics. Fuel cells are simply the most effective way of using our resources of natural gas in a low carbon way."

“Our focus is Korea and Japan. Essentially they are the market leaders because of the high level of government subsidy and their reliance on gas imports, which has grown post-Fukushima.”

Ceres has a test bed manufacturing facility running in the UK which can produce about 400 1 kW fuel cells a year. The next step is a pilot line that will produce up to 3000 fuel cells a year. After that it looks increasingly likely that Ceres’ first volume manufacturing facility will be overseas, probably in Asia. The company has been partnered with a Korean energy firm for a year and is at the evaluation stage with two Japanese OEMs – one is looking at developing a residential system, the other larger systems.

Manufacturing fuel cell stacks at Ceres Power

Manufacturing fuel cell stacks at Ceres Power

Despite the subsidies, Caldwell says that fuel cell systems in Japan and Korea are still expensive, with long payback times that need to get below five years for mass adoption. “The fundamental thing is there needs to be several iterations of the technology to get to the low cost point needed. We’ve been focussed on developing low cost fuel cell technology for the last ten years and now we working on embedding it into the next generation of OEM products .”

Ceres’ fuel cells are cheaper because they do not use lots of expensive platinum as a catalyst, like in PEM cells, or ceramics like solid oxide fuel cells. They are 95% steel. There were problems with robustness associated with cycling, repeatedly switching the fuel cell on and off, admits Caldwell, but these have been solved with a new anode. The company is also using screen printing manufacturing techniques pioneered in the solar photovoltaic industry to increase manufacturing rates. Having addressed these and other similar challenges is what puts the company ahead of the game, he says, and means OEMs are coming to them to licence the technology.

Ceres' second priority is the US market, where Caldwell says business has a growing need for reliable power supply – research indicates grid outages are estimated to cost the US $80bn a year. For example, internet businesses like Google, Microsoft and Ebay want reliable power for their datacentres. Fuel cells are a good fit for use in datacentres because their high power demand is met inefficiently by centralised electricity networks. Distributed, on-site generation from sources like fuel cells make sense.

Ceres is making a play for the US industrial market via a recently announced partnership with US engine –maker Cummins. Alongside the partnerships in Japan, it looks as if the company is finally set to reap the benefit of years of engineering development. “Fuel cells are an everyday thing in Asia now – there are adverts for them on Japanese TV – it just hasn’t hit in the UK and Europe yet,” says Caldwell.

Bloom Energy's fuel cells powering an ebay datacentre in the US

Bloom Energy's fuel cells powering an ebay datacentre in the US

Companies built on false dawns tend to fizzle out quickly, and that Ceres and companies like it are still standing after years of development show that fuel cells do have a future role in the energy mix. However, whether and when the technology spreads from the East into other parts of the world remains to be seen.