Articles

That explains why, following years of Brexit-related uncertainty, then the Covid-19 pandemic, and now challenges linked to the Russian invasion of Ukraine, the energy crisis, and political and economic turmoil, innovation is still the main focus for business investment in the next 12 months.

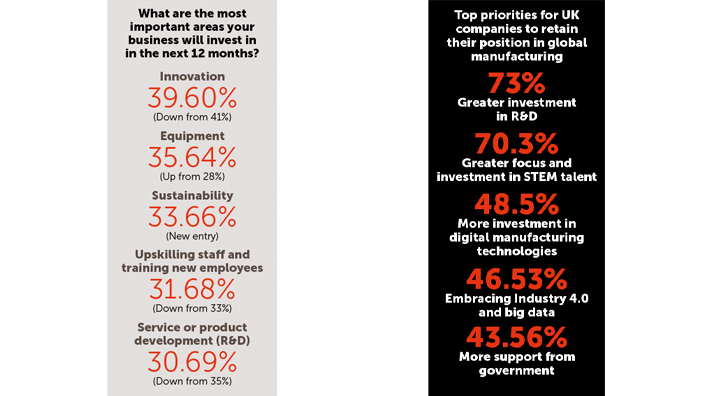

The forward-thinking approach was selected by 40% of respondents as one of the most important investment areas for their organisations in our annual survey of engineers in the manufacturing industry, a slight drop of only one percentage point from 2021.

Working in diverse industries, from plant-based biodegradable packaging to surgical robotics, many readers celebrated the efficiency gains being made possible by Industry 4.0 technologies. Robots and automated processes were in the top-five phrases associated with manufacturing, suggesting increased willingness to streamline production processes, while equipment was the second most important area for investment (picked by 36%, up from 28% last year).

For many, innovation also means an increased focus on sustainability. With industry particularly vulnerable to energy market volatility, and net-zero targets drawing ever closer, new processes, materials, energy-saving measures and carbon capture will help forward-thinking businesses stay relevant and profitable in future.

Some areas will inevitably see decreased investment, however. Service and product development continues to drop down the list of investment priorities, going from 37% in 2020 and 35% in 2021 down to 31% in 2022, perhaps reflecting a cautious approach to business amid persistent uncertainty.

Data-driven improvements

Thankfully, the 111 respondents know what they have to do to become more competitive. Investing in the right talent by developing highly-skilled employees will be the most important factor in the next 12 months, said the engineers, showing the enduring importance of having the right workers for the job.

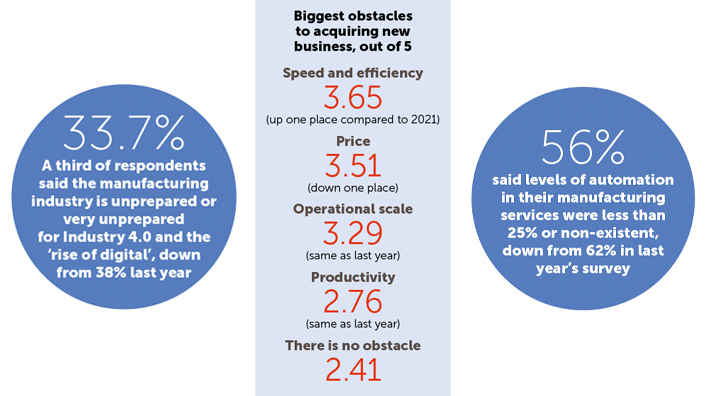

After years of discussion and many clear demonstrations of the benefits, concerns about the sector’s readiness for Industry 4.0 and the ‘rise of digital’ seem to be dropping away. Only a third (34%) said it is unprepared (29%) or very unprepared (5%), down from 38% last year.

Industry 4.0 is “ending the reliance on the ‘black arts’ within manufacturing,” said one respondent. “Manufacturing companies can factually define their capabilities, use data to improve, innovate and provide real-time engagement with their customers.”

Others highlighted the possibilities in defect reduction, improved quality and increased capacity. “Industry 4.0 is making it easier for companies to collaborate and share data among customers, manufacturers, suppliers and other parties in [the] supply chain,” said another participant.

“It improves productivity and competitiveness, enables the transition to a digital economy, and provides opportunities to achieve economic growth and sustainability.”

Automation increase

Challenges include retaining the human touch with customers as interactions are handled by automated systems, the availability of skilled staff, and convincing senior management of the available benefits, said the respondents.

There was also positive movement on automation in manufacturing services at readers’ organisations, 89% of whom were from the UK. Fifty-six per cent said less than a quarter of services are automated, down from 62% last year.

Navigate a turbulent future by attending Aerospace & Defence (28 November – 2 December). Register for FREE today.

Content published by Professional Engineering does not necessarily represent the views of the Institution of Mechanical Engineers.